Insurance is crucial to ensuring individuals have access to high-quality mental health treatment. At Guardian Recovery, we understand the importance of this support. When you or a loved one reaches out to us, one of the first steps we take is conducting a thorough and complimentary insurance benefits check. This process involves verifying the extent of your coverage and understanding the financial aspects of your treatment. It’s designed to give you a clear picture of what your insurance plan covers, helping you make informed decisions about your mental health journey.

Our experienced team will work closely with your insurance provider to maximize your benefits. We simplify the complexities of insurance, making navigating and receiving the care you need easier. This commitment to transparency and support ensures you can focus on your recovery. At the same time, we handle the logistics, helping you achieve the best possible outcome on your path to wellness.

If you or someone you love needs mental health support, Guardian Recovery is available to help. We are dedicated to providing the most comprehensive and individualized treatment programs available. Contact us today to learn more about our mental health treatment and the programs we provide.

SELF-ASSESSMENT:

Do I have an Addiction issue?

Disclaimer: Does not guarantee specific treatment outcomes, as individual results may vary. Our services are not a substitute for professional medical advice or diagnosis; please consult a qualified healthcare provider for such matters.

At Guardian Recovery, we offer comprehensive mental health treatment services to support your journey to well-being. Our services include individual therapy, group therapy, psychiatric evaluations, medication management, family therapy, and addiction treatment programs. We understand that navigating insurance can be complex, but we’re here to simplify the process. Please don’t hesitate to contact us with any insurance questions. Our team is dedicated to helping you understand your insurance benefits, and as an insurance-friendly mental health center, we accept most major health insurance plans.

When you reach out to us, rest assured that we prioritize a compassionate and pain-free admissions process. To better assist you, please be prepared to provide your client’s full name and date of birth, the name of your insurance provider, member ID or policy number, and the type of plan you hold. We’ll handle the rest, reaching out to your insurance provider to ascertain the details of your coverage. Our Treatment Advisors will then communicate this information to you clearly so you can make informed decisions about your mental health treatment. We take patient confidentiality seriously and strictly adhere to HIPAA regulations throughout this process. Your well-being is our priority, and we’re here to support you every step of the way.

Health Insurance Providers We Accept

Guardian Recovery ensures that individuals can access top-notch mental health treatment services. To facilitate your journey to well-being, we proudly welcome a wide range of health insurance providers, including but not limited to:

- Aetna

- Anthem

- BlueCross BlueShield

- First Health Network

- Cofinity Health

- CareFirst

- Florida Blue

- Highmark

- Horizon BCBS

- Independence BCBS

- Molina

- Most Other Insurance Providers

We understand that navigating the intricacies of insurance can be overwhelming, but our team is here to provide support and clarity. Please contact us if you have any questions or concerns regarding your insurance coverage. Our mission is to help you comprehend your insurance benefits and streamline the admissions process, allowing you to concentrate on your path to recovery. Your well-being is our utmost priority, and we are committed to making mental health treatment accessible and hassle-free.

What Types of Mental Health Disorders Are Covered by Insurance?

Insurance coverage for mental health disorders varies depending on your specific insurance plan. However, many insurance providers offer coverage for a wide range of mental health disorders, including:

- Depression – Insurance typically covers treatment for depressive disorders like major depressive disorder (MDD).

- Anxiety Disorders – This category includes generalized anxiety disorder (GAD), panic disorder, and social anxiety disorder. Insurance often covers insurance and therapies used to treat these disorders.

- Bipolar Disorder – Insurance usually covers treatments for bipolar disorder, including mood stabilizers and therapy.

- Post-Traumatic Stress Disorder (PTSD) – Coverage typically includes therapy and medications for PTSD, which often arises from traumatic experiences.

- Obsessive-Compulsive Disorder (OCD) – Insurance generally covers treatments for OCD, including cognitive-behavioral therapy (CBT) and medications.

- Eating Disorders – Many insurance plans cover treatments for eating disorders like anorexia nervosa, bulimia nervosa, and binge-eating disorder.

- Substance Use Disorders – Insurance often covers treatment for substance use disorders, including detoxification, inpatient and outpatient rehabilitation, and counseling.

- Schizophrenia and Other Psychotic Disorders – Insurance plans typically include coverage for medications and therapy for these disorders.

- Attention-Deficit/Hyperactivity Disorder (ADHD) – Insurance usually covers treatments for ADHD, such as medication and therapy.

- Personality Disorders – Depending on the severity and type, insurance may cover therapy and other treatments for personality disorders like borderline personality disorder.

Complimentary Insurance Check

Find Out Today!

"*" indicates required fields

Does Health Insurance Cover Mental Health Medications?

Health insurance often covers medications prescribed for mental health conditions, but the extent of coverage varies depending on your specific plan. Most plans include coverage for generic and brand-name medications, but they may categorize drugs into tiers with different out-of-pocket costs. Prior authorization may be required for certain medications, and you may need to pay co-payments or co-insurance when filling a prescription. Some plans have annual deductibles, meaning you’ll be responsible for the full medication cost until you meet that deductible. Insurance plans may encourage using generic medications when available, and specialty medications may have different coverage terms. Reviewing your plan’s documentation, including the formulary, is crucial to understand your medication coverage fully. If you have questions or need mental health medication coverage assistance, contact Guardian Recovery. We’re here to help you navigate your insurance benefits and ensure you receive mental health treatment and medication coverage.

Does Health Insurance Cover Therapy & Psychiatric Treatment?

Health insurance typically covers therapy and psychiatric treatment for mental health conditions. Here are some key points to consider:

Therapy – Health insurance plans often cover therapy or counseling sessions, including individual therapy, group therapy, and family therapy. The specific types of therapy covered and the number of sessions allowed can vary by plan. It’s essential to check your plan’s coverage details and any limitations.

Psychiatric Treatment – Insurance plans also commonly cover psychiatric treatment, including visits to psychiatrists or other mental health professionals who can prescribe medications and provide ongoing care for mental health conditions. Like therapy, the extent of coverage for psychiatric treatment may vary, so reviewing your plan is essential.

In-Network vs. Out-of-Network Providers – Insurance plans usually have networks of preferred providers, including therapists and psychiatrists. Services from in-network providers typically have lower out-of-pocket costs than out-of-network providers. Choose in-network providers when possible to maximize your coverage.

Co-Payments or Co-Insurance – Depending on your plan, you may be responsible for co-payments (a fixed amount) or co-insurance (a percentage of the cost) when you receive therapy or psychiatric treatment.

Preauthorization – Some insurance plans may require preauthorization for certain therapy or psychiatric treatment types. This means your healthcare provider may need approval from the insurance company before starting treatment.

Mental Health Parity Law – In many countries, mental health parity laws require insurance companies to provide mental health coverage that is comparable to coverage for physical health conditions. These laws ensure that individuals have equitable access to mental health treatment.

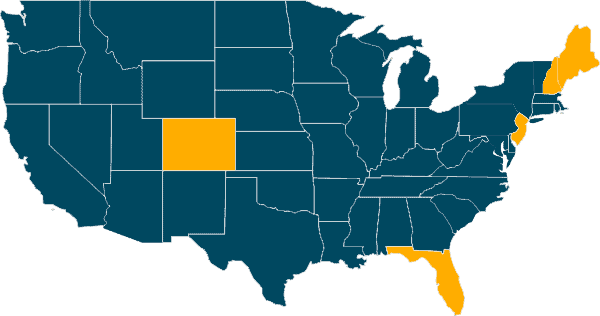

Our Locations

Our Facilities & Teams Transform Lives

Changing lives by providing comprehensive support and rehabilitation, empowering individuals to overcome addiction and regain control of their health and well-being.

Verify Insurance Benefits & Coverage

At Guardian Recovery, we’re dedicated to simplifying the process of verifying your insurance benefits and coverage for mental health treatment. To get started, please call us; our experienced team will guide you through the necessary steps. We’ll communicate with your insurance provider to provide you with a clear understanding of your coverage, helping you navigate the financial aspects of your treatment. Rest assured that we prioritize your privacy and adhere to all relevant regulations throughout this process. Your well-being is our top priority, and we’re here to assist you every step of the way.

SELF-ASSESSMENT:

Do I have an Addiction issue?

Disclaimer: Does not guarantee specific treatment outcomes, as individual results may vary. Our services are not a substitute for professional medical advice or diagnosis; please consult a qualified healthcare provider for such matters.

Sources